It’s been pretty mcuh a yeat since we started investing for out child, how has recently celebrated his 1st birthday. We had a great day and a lovely weekend with family. He’s growing up fast, trying desperatelyt o speak, poitning at his balloons and getting really close to standing upsupported.

In terms of his investment in my ISA, this currently stands £2005.39. This includes some recent inputs following his birthday but doesn’t include the most recent child benefit payment which is in my bank account. It does this for just over 3 weeks every month because of the timings of HL’s regular savings.

My target is to reach £20,000 by the time he is 17 or 18 (I haven’t decided yet). I’m confident we are on track, which I’ll return to later.

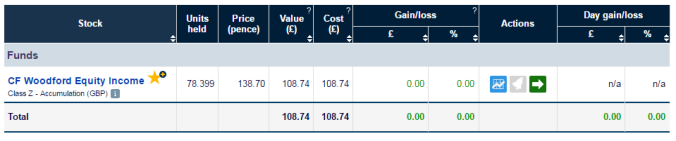

His portfolio breaks down as follows:

The explanations of this are below with their 28/2/107-28/2/2018 performance in brackets (although I haven’t necessarily been invested in them for that long nor seen that performance).

BlackRock consensus 100 (+7.47%)

This is his ‘Port Fund’! Rather than invest in a bottle of port or wine for his birthday to be opened at a big birthday in the future, I decided to invest £100 of the money received at his Christening to buy one in the future. I chose this because it seemed similar to Vanguard LS (it was initially invested in VG LS 80 but I changed because I thought I wanted to keep that open for the future – hence the higher initial cost. £100 should be seen as the baseline for this). I’ll just let this one grow.

FP Crux European Special Situations, Liontrust Special Situations and Schroder US Mid Cap Growth. (+14.56%, +7.53%, -2.91%)

These are the ones that his monthly investments have been going into. I started them before I had even heard of Vanguard and tracker funds. I was seduced by their past performance but there are some fees north of 0.71% here. They’ve been up and down over the last year and the European fund has been doing well. The US fund has, however, been beaten by trackers in the last year.

As such I’ve stopped paying into the European Fund and the US Mid Caps. Instead, £50 per month will go to the HSBC tracker, and £25 still to Liontrust. Part of me is curious to see how an Income fund goes and its UK based so I am prepared to keep it.

I’m still unsure whether or not to keep these or sell them to consolidate into other funds.

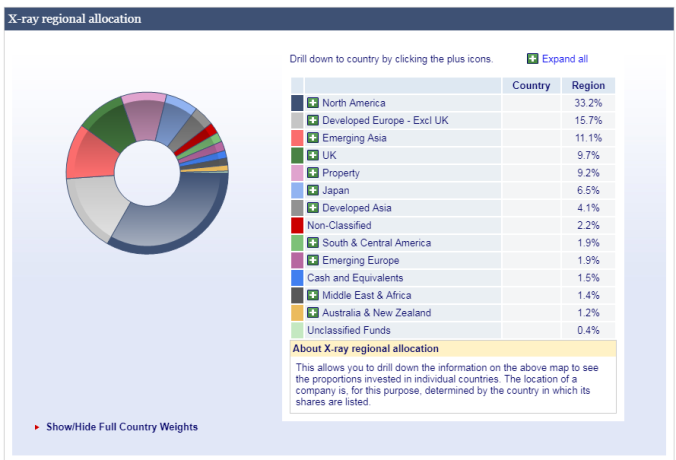

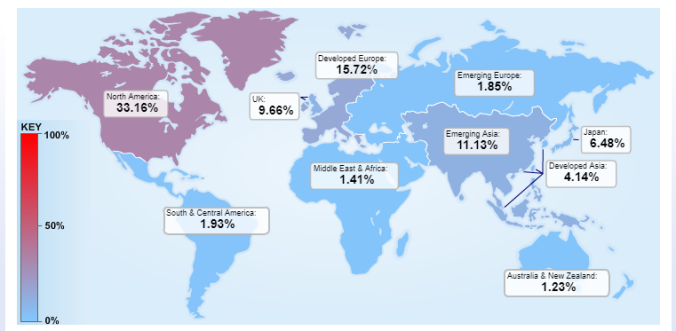

HSBC FTSE All World Index (+7.58%)

This purchase only settled yesterday for the first time with a £265 of birthday money input. I chose it based on the fact that it was All World rather than developed world and as such has some emerging markets in it. It was started in 2014 and is similar to VG LS 100 but the charges are slightly less (0.16% vs 0.22%). This will replace the two fund above as a monthly contribution target.

Marlborough UK Micro-Cap Growth (+23.54%)

This money was initially in the HL Income Select Fund and one of his first purchases. Again, this was before I had heard of tracker funds and I was seduced by HL and the novelty of monthly dividends. I sold it a while back and put it into this. This satisfies my itch for ‘active’ funds and yes, I know I’m going on past performance, but I’m happy with my decision.

Vanguard LifeStrategy 100 (7.36%)

I’m a big fan of this fund and will probably keep it for a very long time. I don’t have a regular saving here but every time his savings account hits £100 (a combination of small gifts or the remaining £7.20 each month from child benefit) I buy some of this. It’s been quite high this year but due to the recent fluctuations the growth has been a little lower. The figure above also includes an injection of £260 of birthday money.

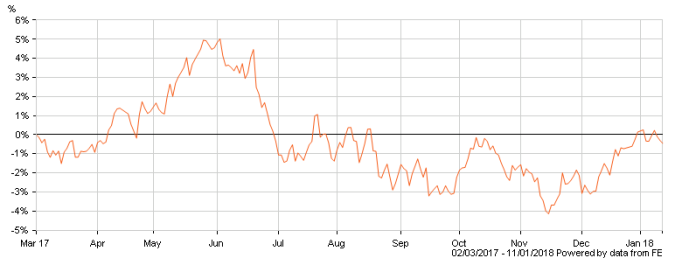

Overall performance

According to HL the portfolio has gained 0.42% in total. However this fugure is pretty meaningless given that over 25% of the portfolio was invested in the last 2 days. Plus some of them are not the original investment fuigures of £100 becuase I originally invested in other funds.

Factors affecting the performance are the recent ‘correction’ which did fall on the day when the monthly savings take place, which was good. Nevertheless, any of the monthly savings were put in as markets were going up – higher than they are now.

But I’m happy with this performance and looking forward to the coming years to see how else it goes.

Inputs

The child benefit saving is doing well and I like it. It equates to just over £993 a year. The total inputs are probably a little flattering because he got some cash when he was born, some cash for his christening and some recent birthday cash which was rather large. We can’t count on these in the future so total contributions will probably be closer to £1000pa. Nevertheless, we’ve put in lots to start which, through the miracle of compounding, will see us right.

Target

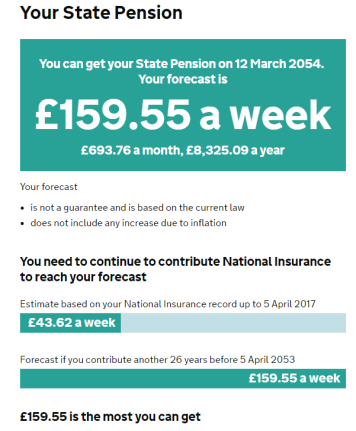

In terms of my target of £20,000 by the time he is 17 of 18, this is what that looks like:

Assuming the current £2000 lump sum and £82 per month investment, a decent 6% growth rate and 2.5% inflation it looks at follows:

By the time he is 18 = £26,352.65 (£34,041.29 ogoring inlfation).

By the time he is 17 = £24,492.83 (£31,156.22 ignoring inflation).

Of course this does not include anything we take out, which is possible as he gets older, but also doesn’t include any extras we put in.

So overall, a great start I think! There are quite a few points here that I aim to elaborate on in future posts and I think the next year will see some further consolidation of the portfolio. But also some growth hopefully!