Back in March, at the start of my investment for the boy, he received some money. Being bombarded by some of the marketing from Hargreaves Lansdown, and not really knowing anywhere near what I know now, I bought £100 worth of their in-house ‘HL Select UK Income Shares’ for £1 each.

The fund is ‘a portfolio of high-quality, dividend-paying UK shares, chosen and managed by our experts in the convenience of a single fund. The fund aims to offer an attractive and growing level of income with long-term capital growth potential.’

What interested me was the transparency – they would publish their holdings, and importantly – the managers write a weekly blog to share their strategy and thoughts on the market, why they have bought certain shares and why they are holding on to others.

I think they initially said that they would pay a monthly dividend of 0.3p, which sounded ok and different to the normal process of annual dividends. After about 6 months they would assess this.

The fund had a big uptake of people; the fact sheet currently says it has a size of £232 million. The total charge is 0.6%.

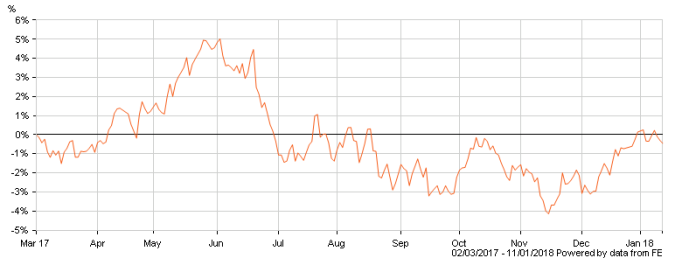

After an initial spurt of growth (see below, the fund went South and never really recovered back up to the initial £1 price. Similar issues that have affected Neil Woodford (Friends Provident especially – although HL stuck to their guns initially they got out of it sooner than Woodford).

Share price since launch – 11th Jan 2018.

The HL Top 10 as of 12th Jan

As such, I decided to sell this fund at the start of December for £96.90, a loss of £3.10. I decided to go for another fund that HL keep pushing; Marlborough UK Micro Cap Growth. This is a bit more sporty, much more volatile but seeing as this was an initial £100 that was available for investment over 18 years or so, it fitted my overall strategy.

Knowing what I know now – I know it’s not a passive fund. The net charge is 0.75%. But I’m happy if it perhaps scratches the itch to be more active or have something that (currently) beats the market and provides great returns. I sold the HL fund because of poor performance – even thought it was based on income and should have been slow and steady.

After a month of investment the fund is up 7.41%. So my £100 has gone down to £96.90 but is now back up to £104.08. I know that past performance isn’t an indicator of future performance. But I am happy with getting rid of the HL fund, which was under performing, and swapping for something a bit ‘racier’ in comparison to the rest of the portfolio which has a very long-term outlook.

As always, do your own research.